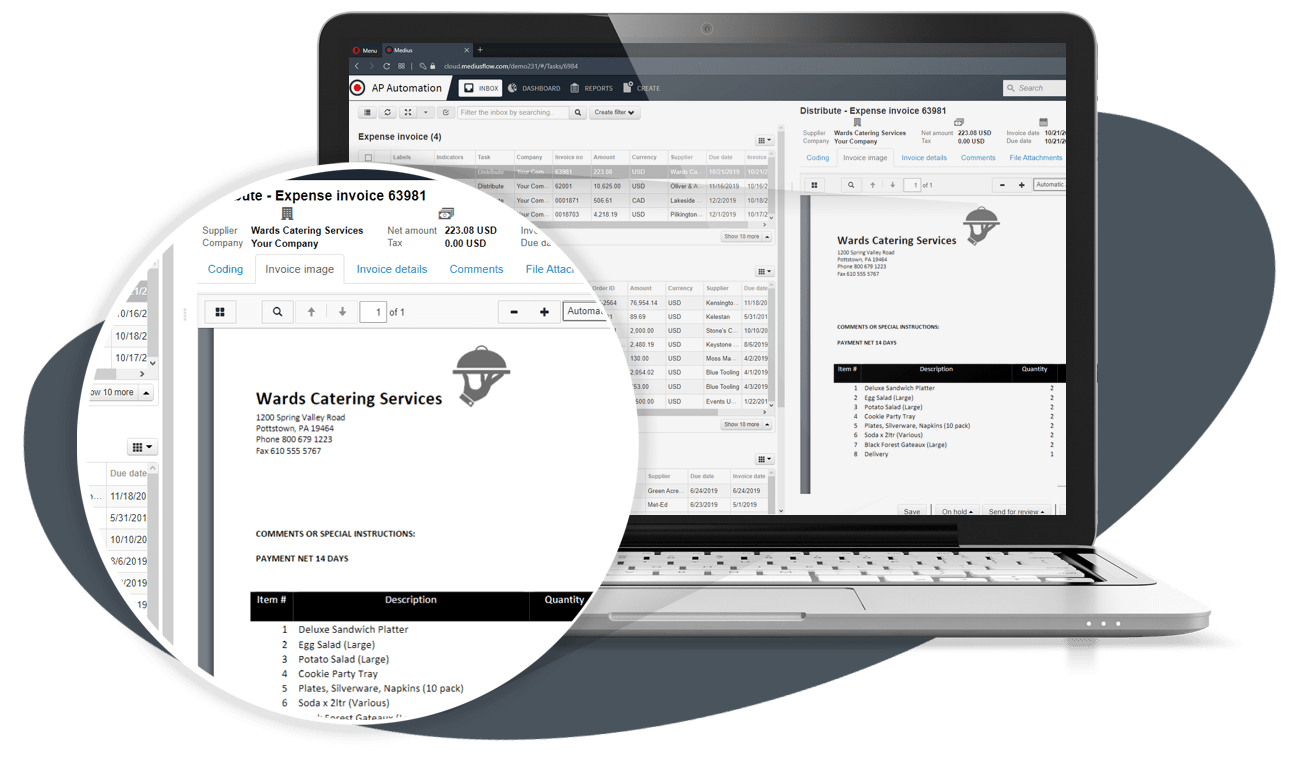

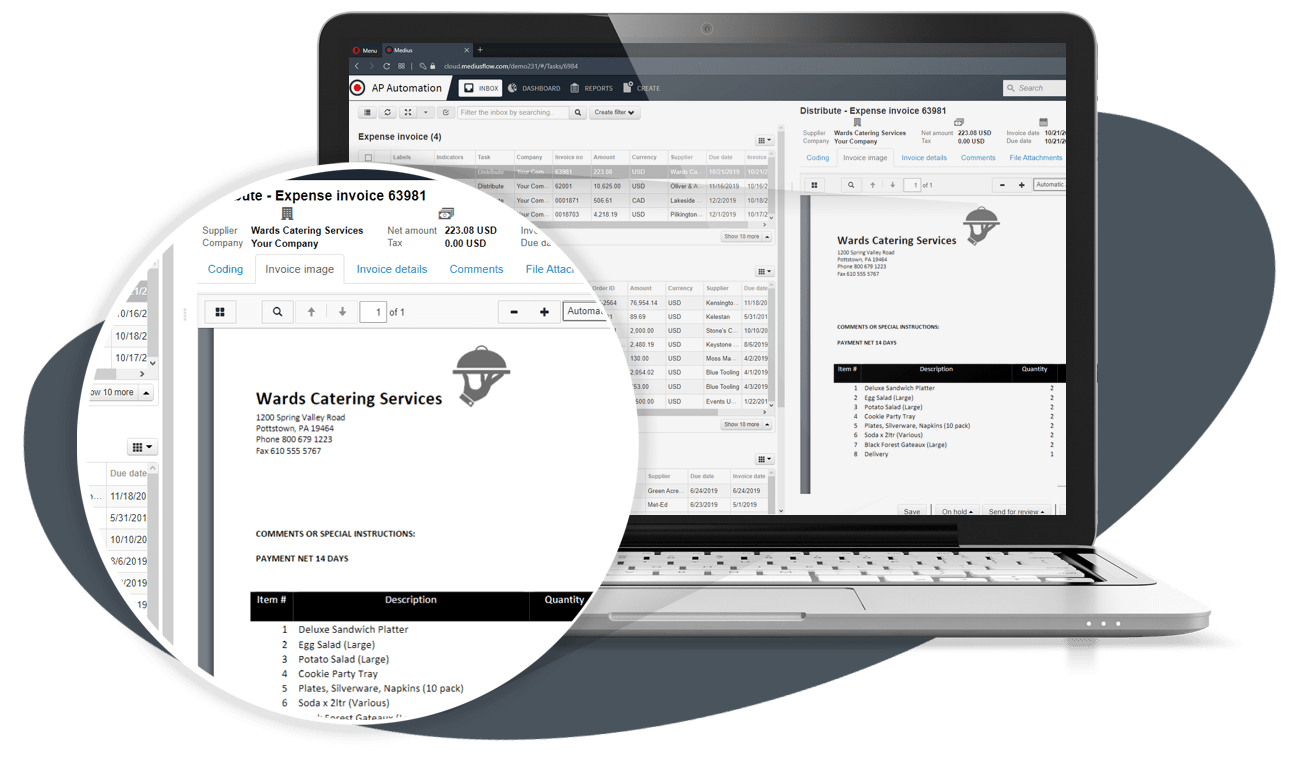

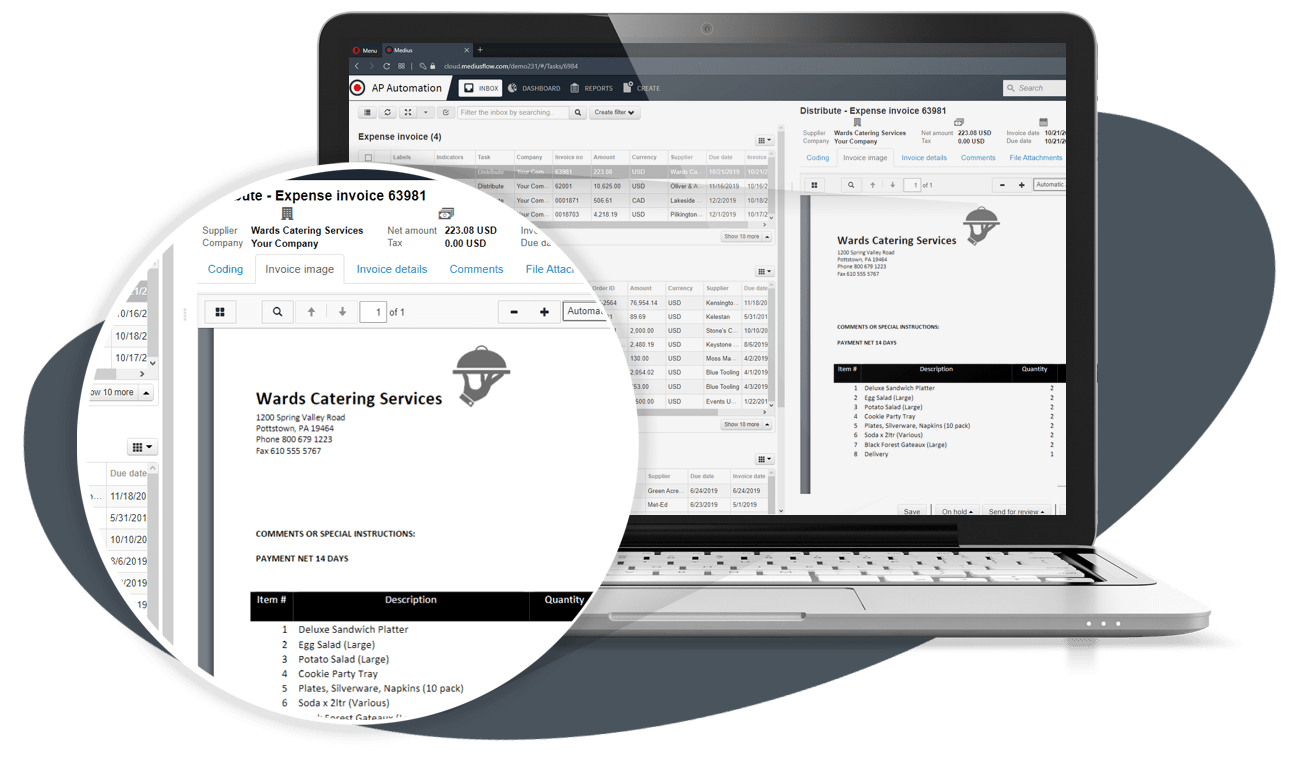

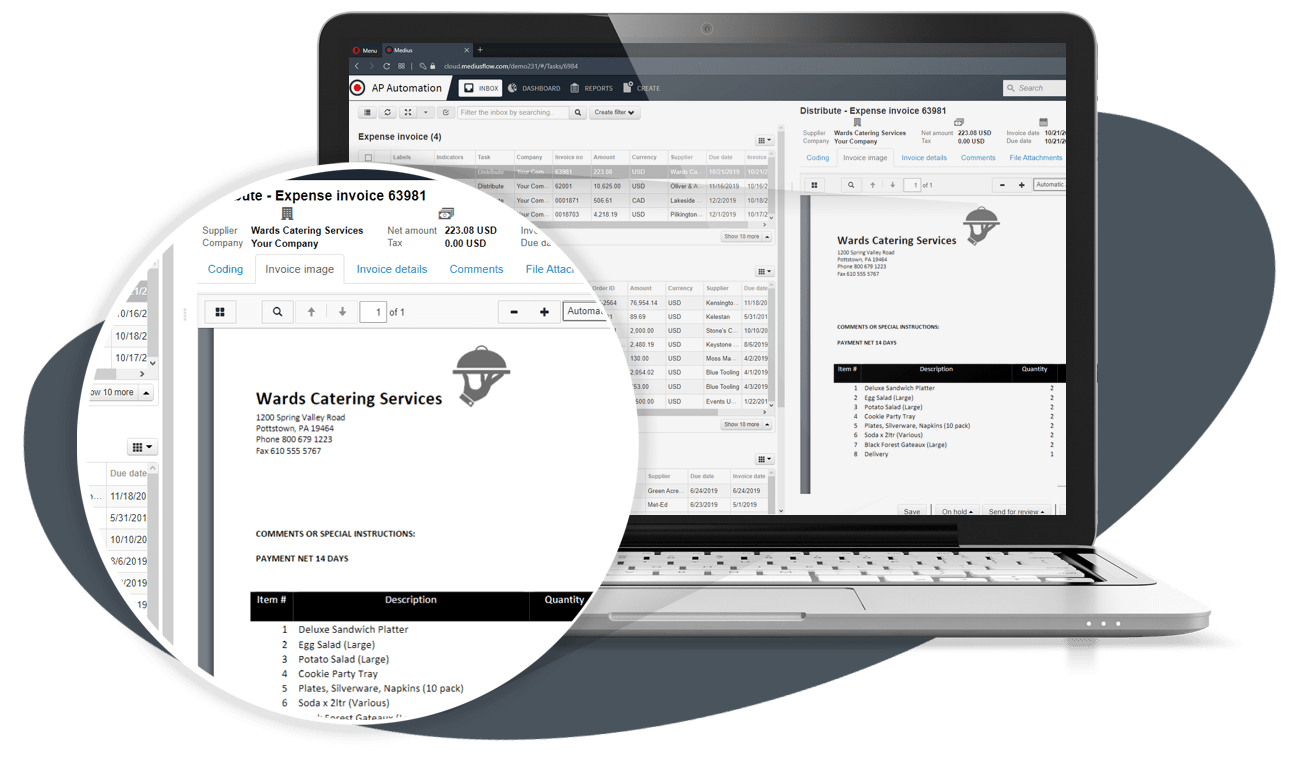

Digitize your AP processes with Medius Accounts Payable Automation

With Medius Accounts Payable Automation, turn manual, paper-based invoices into digital workflows. Manage and pay invoices on time, reduce risk of fraud and payment errors, improve compliance, and optimize your working capital.

Why Medius Accounts Payable Automation?

Get rid of paper invoices

By using Artificial Intelligence (AI), machine learning, OCR, and other technologies, Medius Accounts Payable Automation solution will electronically capture, digitize, and process invoices within our unique accounts payable platforms – regardless of their format.

Improve operations

Stop inefficient, manual invoice processes that increase the risk of fraud and payment errors, limit data insights and analytics, and prevent teams from getting work done. Discover the difference that top accounts payable automation software could make to your team.

An integrated procure-to-pay process

There's a reason why accounts payable workflow automation is soaring in popularity. All invoice data – from supplier details to payments – are synchronized from your ERP or accounting system to the Medius AP automation platform, ensuring accurate information across the procure-to-pay lifecycle.

AP has a high risk for excessive cost and fraud. Take control.

Common challenges you face

- 45% of invoices have exceptions requiring manual intervention*

- 57% of finance professionals say the invoice and payment process takes too long*

- Less than half of organizations can measure key AP metrics*

- Manual processes cannot be managed in a work-from-home environment

*Source: Ardent Partners: The State of ePayables Report 2021

Risks of not having a solution in place

- Business payment fraud attacks impact nearly four out of 10 businesses*

- Human error and inaccuracy can lead to financial losses and problems

- The cost to manually process invoices continues to rise

- Staff spend an increasing amount of time responding to inquiries

*Source: Ardent Partners: The State of ePayables Report 2021

Rewards of the Medius AP Automation solution

- Increased efficiency because everything is automatically processed

- Invoice exceptions can be dramatically reduced saving time and money

- Identify and mitigate fraud risks and protect your financial health

- Analyze spend data to determine where you can optimise working capital

- Access to some of the industry's best accounts payable management software

Common challenges you face

- 45% of invoices have exceptions requiring manual intervention*

- 57% of finance professionals say the invoice and payment process takes too long*

- Less than half of organizations can measure key AP metrics*

- Manual processes cannot be managed in a work-from-home environment

*Source: Ardent Partners: The State of ePayables Report 2021

Risks of not having a solution in place

- Business payment fraud attacks impact nearly four out of 10 businesses*

- Human error and inaccuracy can lead to financial losses and problems

- The cost to manually process invoices continues to rise

- Staff spend an increasing amount of time responding to inquiries

*Source: Ardent Partners: The State of ePayables Report 2021

Rewards of the Medius AP Automation solution

- Increased efficiency because everything is automatically processed

- Invoice exceptions can be dramatically reduced saving time and money

- Identify and mitigate fraud risks and protect your financial health

- Analyze spend data to determine where you can optimise working capital

- Access to some of the industry's best accounts payable management software

Break the accounts payable bottleneck with Medius AP Automation

Three-way matching

Automatic three-way matching allows your business to resolve discrepancies in invoices, POs, and receivables. You can safeguard your assets, avoid fraudulent invoices, and make sure you pay the correct amounts.

Intelligent invoice and touchless data capture

Our state-of-the-art data capture solution is native to Medius AP Automation and expertly pinpoints and extracts invoice data automatically. It’s powered by our innovative ‘touchless capture’ technology – clever AI that removes guesswork. Original invoices are automatically archived in Medius AP Automation for you to audit whenever you need them.

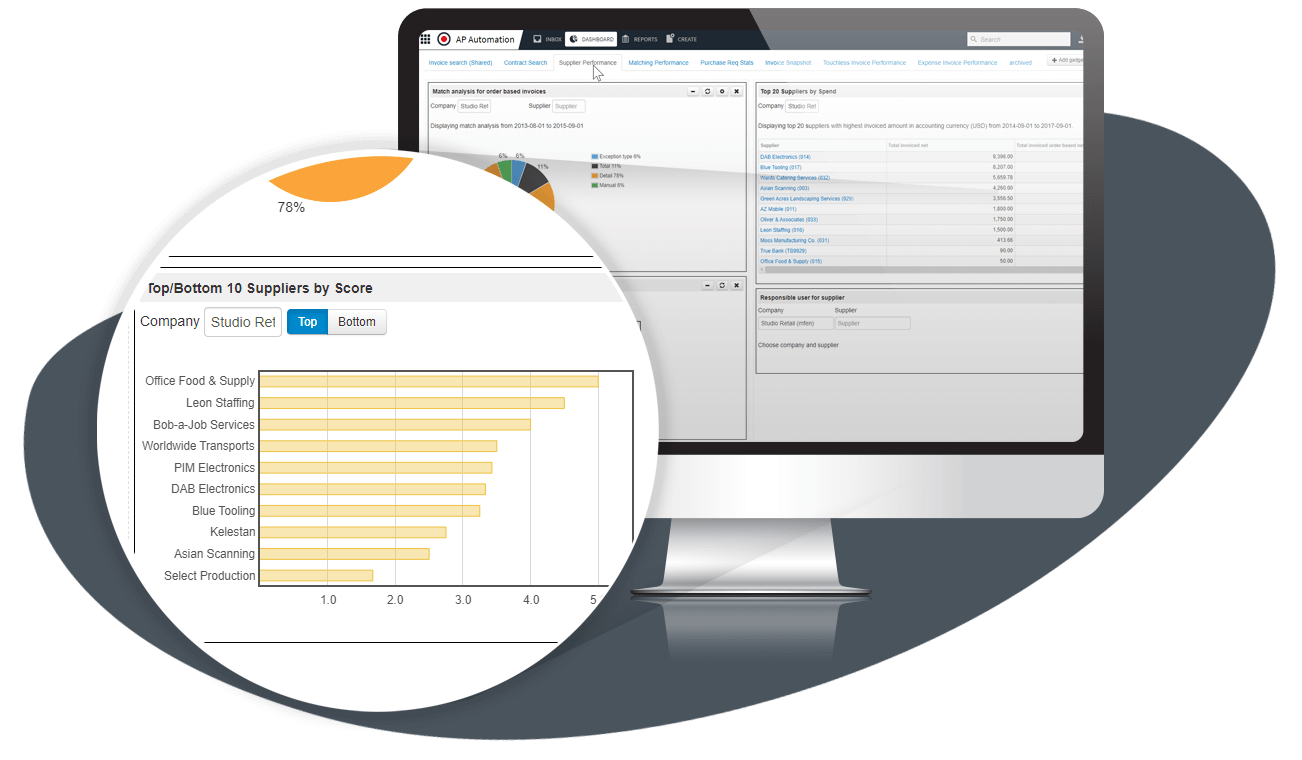

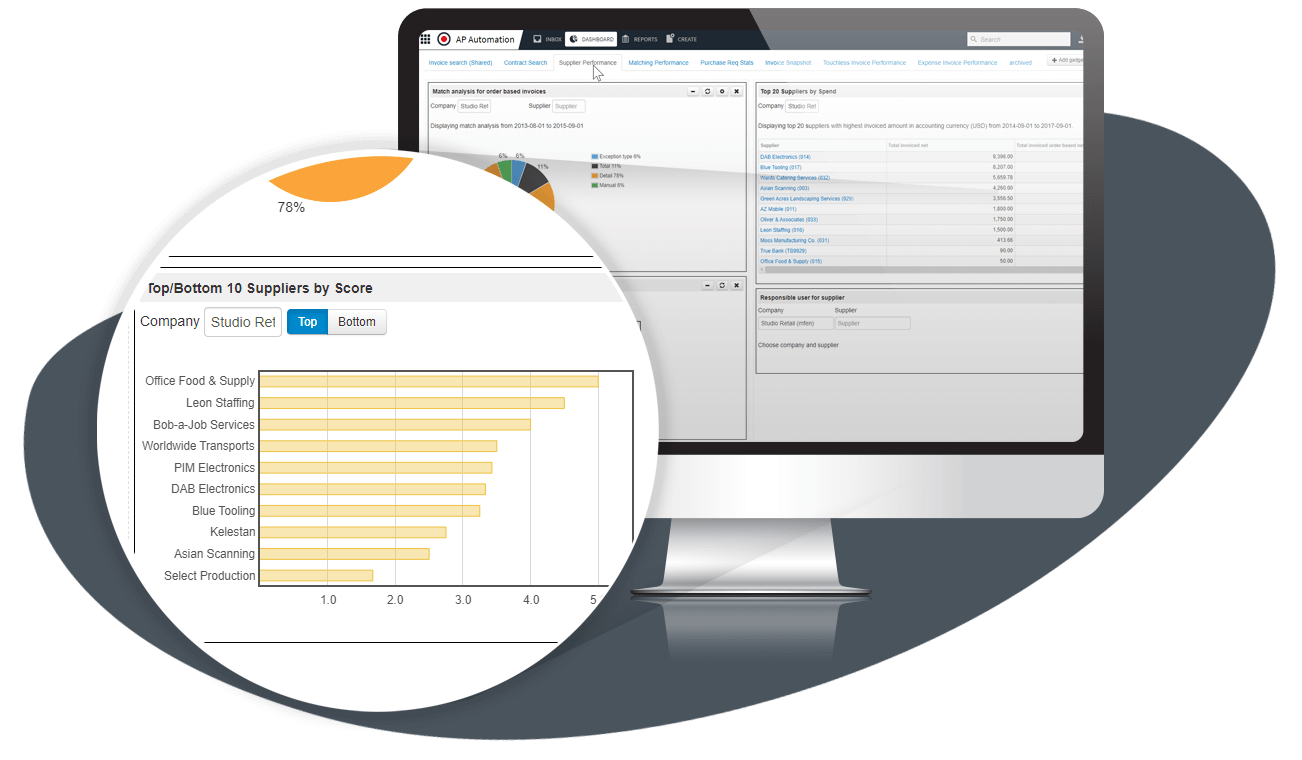

Use spend data to make better business decisions

Utilizing account payable solutions will allow you to broaden your insight into your business spending. Predefined reports, dashboards, and KPIs give you a full view into how money is spent and help you better manage cash flow. Study captured and missed discounts, working capital and more so you can tune operational performance.

Integrate with Microsoft Dynamics, SAP, Infor, and more

Integrate Medius Accounts Payable Automation with your organization's ERP or accounting system and connect solutions across the procure-to-pay lifecycle. Out-of-the-box integration makes it easy for your IT team to onboard AP Automation, managing the systems and processes with a predictable timescale and set of resources.

Streamline the supplier payment process

Integrate Medius AP Automation with Medius Pay for a simple, secure, and streamlined vendor payment process that allows you to pay all your domestic and international suppliers via a single channel.

Integrate Medius AP Automation with your back-office

Rapidly bring together your back-office and third-party systems using Medius Connect. It features:

- Out of the box connectors for major ERP systems means a rapid and predictable implementation

- Native embedded capture means a single user interface to manage all invoices from initial input to final approval

- Seamless integration with our modular solutions - such as Medius Pay - to complete, initiate, and manage payments, Medius Contract Management to tie contracts to payment agreements, and of course Medius Procurement to ensure employees order the right goods and services up front and invoices can be automatically matched without issue.

Join these organizations who depend on Medius to spend smart

The benefits of AP automation

Human error is a risk in any process, and there’s plenty of room for mistakes to occur in traditional, labor-intensive accounts payable departments. By using AP automation software, these processes can be automated, reducing risk and fraud to ensure that finance operations run more smoothly.

Using AP automated systems removes the need for dated paper filing systems, and the storage space required. Easily convert paper invoices, POs, or other finance documents into a digital format. By digitizing data, organizations can extract more value from these documents that are otherwise literally gathering dust and occupying space.

How can you measure your company spending if you can’t see it? You need both a holistic and a detailed view of spend across the procure-to-pay lifecycle so that you can optimize your working capital. With Medius Analytics you get dashboards and reports to help you increase cash flow visibility, better manage suppliers, drill into process bottlenecks, and so much more.

ePayments offer a higher level of efficiency, visibility, and accuracy to your organization and to your extended supply chain. Plus, you get greater collaboration between trading partners with financial value for everyone.

With an automated accounts payable solution, work flows from person-to-person, system-to-system and logical next steps “just happen,” so your teams won’t get bogged down with process and they can get more done.

Bring a data-driven approach to your AP

AP: work smarter, not harder with Medius Analytics

Use your accounts payable team’s secret weapon – its own data – to boost operational efficiencies with Medius Analytics. Our deep-dive dashboards and reports help you increase cash flow visibility, better manage suppliers, drill into process bottlenecks and so much more.

Download our brochures to see what Medius can do

Download our brochures to see what Medius can do

More resources we think you'll like

More resources we think you'll like

Don't take our word for it. Hear from one of our clients.

Medius has been really important for me to be able to do my job - gone are the days where we go to cabinets and pull invoices!

Blanca McGrory

AP Manager, Lush Handmade Cosmetics

Accounts payable automation software FAQs

Accounts payable automation software refers to technology that is used to streamline and automate accounts payable processes, removing manual tasks and providing better visibility and control over important financial data.

Accounts payable automation is the process of eliminating many of the manual aspects of accounts payable systems. It’s specifically useful in facilitating the automatic creation, review, and approval of invoices digitally, rather than having to receive, scan, and manage paper documents.

There are plenty of accounts payable automation vendors out there, but we believe we've put together a line of accounts payable tools that stand to revolutionize the way you work. With the Medius Accounts Payable Automation solution, AP processes can be streamlined and managed more efficiently to provide better visibility and control over an organization’s finances.

By using automated software, you can be more efficient, reduce errors and risk, and allow your company to scale quickly and easily.

AP automation software converts your suppliers’ invoices into a standard digital format and then uses a series of digital workflows to verify and process the information throughout the procure-to-pay lifecycle.

AP automation software uses Artificial Intelligence (AI), machine learning, optical character recognition (OCR), and other technologies to extract information from invoices and convert them from paper documents into digital formats. These supplier invoices can then be processed via digital workflows to manage steps in the procure-to-pay process previously handled by an AP staff member.

With AP automation software, you can automate the entire AP process – from invoice capture to payment so your organization can:

- Control costs and get better visibility of working capital

- Reduce time AP staff spends on data entry, auditing, and exception handling

- Improve supplier relations

- Capture early payment discounts

- Reduce the risk of payment fraud

Organizations that wish to automate accounts payable usually implement an AP automation solution that is connected to the ERP system and other finance applications. Today, there are cloud-based accounts payable software options on the market, like Medius AP Automation and MediusGo, to suit companies of all sizes and industries.

Automation of accounts payable works differently depending on the type of supplier invoices that are being handled, the spend management policies of the buying organization, and the invoicing capabilities of the supplier.

In many cases, the accounts payable automation software will support automatic data capture from invoices sent by mail in a paper format, or by email, and then automate coding, and distribution of the invoice to the appropriate approver within the organization, before payment is made. Some organizations ask their suppliers to submit invoices using a supplier portal, and the AP software takes over from there.

In other scenarios, especially in direct materials procurement, a supplier may send an invoice by electronic data interchange (EDI). The accounts payable automation system will match the invoice data to the purchase order and directly send the invoice for payment, without any human intervention whatsoever. This is what is referred to as touchless invoice processing and the end goal of automation in accounts payable.