Autonomous Accounts Payable: driving end-to-end workflows with AI

Take a closer look at the current state of AP and find out where businesses stand regarding AI in AP departments and the solutions AI offers to AP challenges.

There’s a gap in AP Automation

7 ways finance professionals describe their

organization’s approach to AP automation

These results indicate many companies are aware of how valuable automation would be for their accounts payable processes — but are finding it difficult to get the ball rolling on their automation journey.

How Autonomous AP differs from AP Automation

Basic AP automation systems require configuration to be maintained by humans

An autonomous solution maintains itself with the help of AI and Machine Learning (ML).The ability to both compile data and manage invoice processing without human oversight goes beyond anything seen in other automation systems.

Two AI technologies of autonomous AP that are at the forefront of changing AP processes are intelligent document processing (IDP) and OCR. For best results, you need a resource capable of lifting and understanding text from these paper documents, which is why OCR is so valuable when paired with IDP.

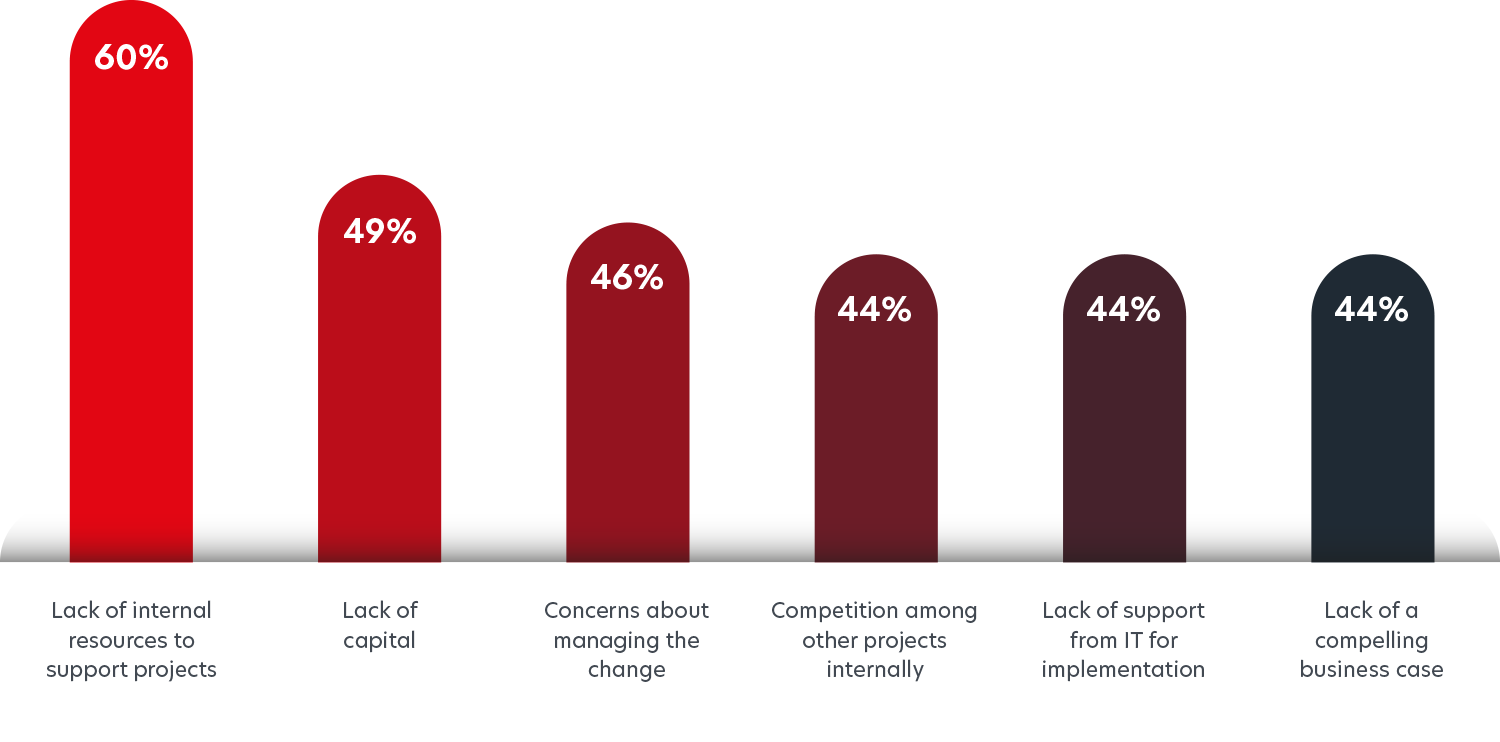

Top 6 reasons companies aren't automating AP

What is preventing your organization from switching to Automated AP Solutions?

- 60% Lack of internal resources to support projects

- 49% Lack of capital

- 46% Concerns about managing the change

- 44% Competition among other projects internally

- 44% Lack of support from IT for implementation

- 44% Lack of a compelling business case

These only brush the surface of the roadblocks we found in our survey. Download the report to get all the data!

Overcoming manual invoice processing at Chadwell Supply

Without Medius we would have needed to double or triple the headcount, but we’ve been able to maintain the volume, with the team that we had.

Mayra Perez

AP Manager | Chadwell Supply

Want to know more about how we helped Chadwell Supply? You can watch our video case study now.

Implementing Autonomous AP

But what’s the first step to take? To start a successful AP automation, you must first:

1. Perform an objective end-to-end process assessment and benchmarking

2. Identify the 3 P’s to support the automation: people, process, and products

3. Establish your tactical and strategic approach in your automation journey, set your priorities, measures of success and bring your stakeholders onboard and align your goals with the overall organizational digital transformation plans

Beyond the research

Check out the Q&A session SSON conducted with our VP of Capture and AI — Katarina Anderson.

Katarina Andersson: I think one thing that’s well known in invoice processing is that PDF invoices help you be more automated because you don’t have to deal with manually keying in information which brings a greater risk of errors and takes a lot of time. PDFs provide a well know format that everybody knows how to use and are not perceived as technical. PDFs helps give greater insight and control to your invoices, all while reducing manual labor. PDFs are also easier to archive than a paper invoice because they come in a digital format and don’t require human filing. You can use AI tools to easily scan, interpret, and place PDF invoices

in the correct archives for easy access.

KA: The whole concept of “electronic” invoices has been around for 20+ years. I think it’s important to define what an “e-invoice” actually is. An e-invoice is one that is submitted electronically, i.e. it’s not a paper sent by post. This could be a PDF attachment to an email that is handled automatically by a system or a true point-to-point solution like EDI or an invoice network solution that allows a one to many connection.

The reason PDFs had been utilized more is because they are not as technical as E-invoices, which require technical skills to map fields from supplier invoice to customer invoice record and can still remove a lot of manual work. However, because of the global pandemic, governments have been requesting businesses to file their expected tax receipt through e-invoices which can be regulated and to collect their money in a more controlled manner.

KA: Businesses are realizing that with the electronic invoice solutions that are available, such as the one we offer at Medius, there are AI capabilities that are making all E-invoices less technical because we don’t have OCR errors, just validation and mapping errors. These solutions make it so E-invoices no longer require c constant oversight and maintenance from IT, and that AP teams can manage these invoices even if they lack technical skills.

KA: Medius loves all invoices! It’s worth pointing out that our solution is a single UI for invoice capture, processing and payment therefore, giving AP teams end-to-end control of their invoice process in a streamlined fashion.

Medius uses Machine Learning to learn through the manual corrections to invoices, either from exceptions that must be manually altered again and again, for example challenges with PO number formats or a supplier identification that can cause issues. Medius learns these details and while you can go back to the supplier time and time again, Medius can just fix it for you each time – saving you – and your supplier - the cost and time of changing supplier invoice files and resending.

It also doesn’t just extend to supplier mistakes, ML can detect things like fraud and double payments through IP addresses for example, which ensures things such as fraud are caught really early in the invoice process.

Machine Learning also helps once invoices are in the system and not matched to PO's. There is often the manual task of invoice routing to the correct person for approval and the coding that needs to be done so it is accounted for properly in finance systems. Once the system has “seen” the user make the same updates again and again it easily learns what to do, allowing a business person to focus on exceptions, not the day to day

KA: Employees don’t want to learn multiple applications that require multiple logins and several training sessions. We hear from clients that what they love about autonomous AP is the single log-in and Machine Learning. The longer employees work with it they also see how helpful it is at capturing the invoice data, and how it removes manual touchpoints they were responsible for throughout the process.

AP teams are not typically made up of technical people. They are numbers people, and they want control

of their data and processes. So, if we give them that control, give them a way to prevent fraud, and remove the maintenance E-invoices require, we allow employees to work on the tasks they want to work on. Another benefit for employees is that autonomous AP solutions provide statistics to AP teams that help them understand where they are getting better and shows them what resources they might need for years to come.

Want to know more? Get our free report:

Autonomous Accounts Payable:

Driving end-to-end workflows with AI

The goal of this report is to illustrate how autonomous AP has become the great differentiator for businesses looking to improve their end-to-end processes.

Autonomous AP does not require constant oversight from IT to implement, it can be an easy plug and play solution that quickly helps AP teams overhaul their processes.

Ready to try Autonomous AP with Medius?

Book a demo with our team to see first-hand how Medius can make the difference in your AP processes, or check out one of these related resources.