Disorganized crime.

Messy paper trails and manual processes make invoice fraud easy.

Organized crime—yes, that organized crime— is becoming more professional, and along with a few rogue individuals, is thriving on disorganized invoice processes.

-

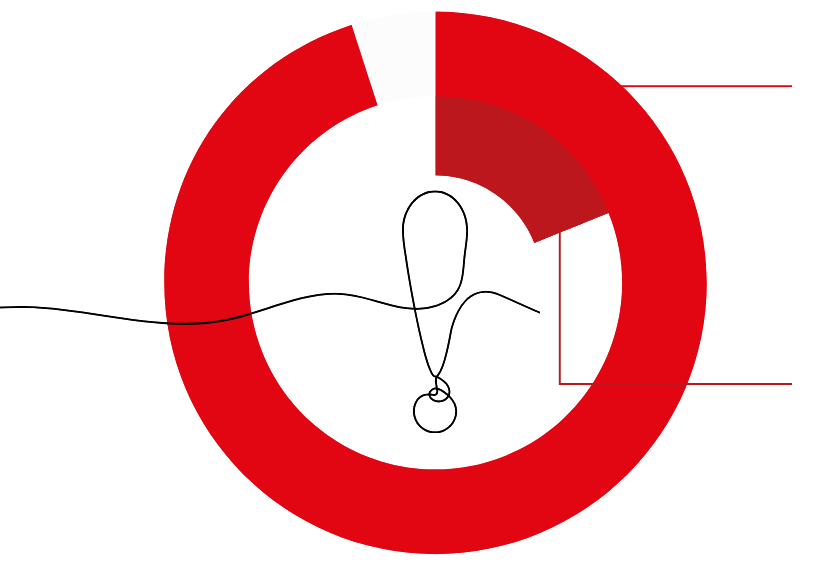

95% of businesses have seen invoice fraud in the last year.

-

34,000 cases across the 2,750 businesses sampled globally.

-

1 case per month, on average, but 19% of business have seen as many as 30 cases in the last year.

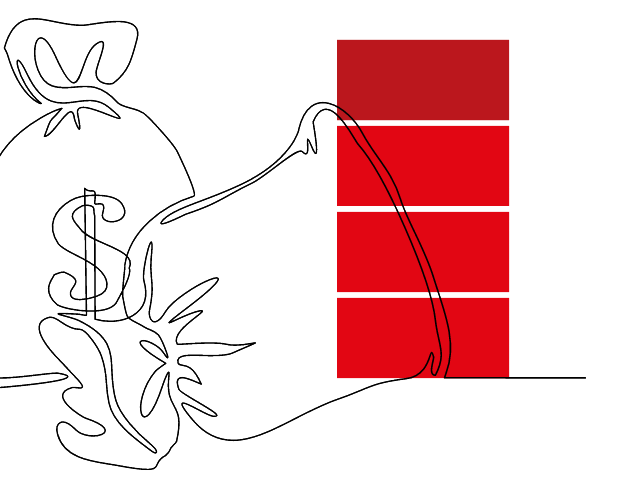

$280,000 is a lot to lose.

25% of finance professionals are unable to estimate how much fraud is costing them—because they’re often unaware that it’s happening—but the other 75% put the cost at well over a quarter of a million dollars annually.

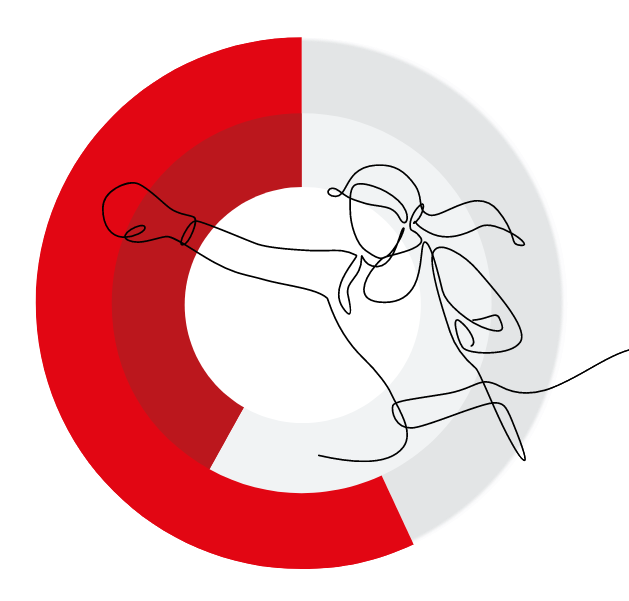

Are you fighting this with one arm tied behind your back?

Finance leaders are trying to take on fraud, but mostly on their own.

57% of businesses say the responsibility to fight fraud is NOT shared between finance and IT.

Only 42% of companies collaborate to prevent and catch payment fraud.

Here’s how you stop it.

- Validate important vendor data—make sure they are who they say they are.

- Build in some regulations and a few checks and balances.

- Invest in anomaly-detection technology, so if something isn’t right, it stands out.

- Automate payments and protect the invoice process, end to end.

What’s the answer?

If you want to dive deeper—and fight fraud

more effectively—visit medius.com.