Digitize your AP processes with Medius Accounts Payable Automation Software

With Medius Accounts Payable Automation, turn manual, paper-based invoices into digital workflows. Manage and pay invoices on time, reduce risk of fraud and payment errors, improve compliance, and optimize your working capital.

Why Medius Accounts Payable Automation Software?

Get rid of paper invoices

By using Artificial Intelligence (AI), machine learning, OCR, and other technologies, Medius Accounts Payable Automation solution will electronically capture, digitize, and process invoices within our unique accounts payable platforms – regardless of their format.

Improve operations

Stop inefficient, manual invoice processes that increase the risk of fraud and payment errors, limit data insights and analytics, and prevent teams from getting work done. Discover the difference that top accounts payable automation software could make to your team.

An integrated procure-to-pay process

There's a reason why accounts payable workflow automation is soaring in popularity. All invoice data – from supplier details to payments – are synchronized from your ERP or accounting system to the Medius AP automation platform, ensuring accurate information across the procure-to-pay lifecycle.

AP has a high risk for excessive cost and fraud. Take control.

Common challenges you face

- 45% of invoices have exceptions requiring manual intervention*

- 57% of finance professionals say the invoice and payment process takes too long*

- Less than half of organizations can measure key AP metrics*

- Manual processes cannot be managed in a work-from-home environment

*Source: Ardent Partners: The State of ePayables Report 2021

Risks of not having a solution in place

- Business payment fraud attacks impact nearly four out of 10 businesses*

- Human error and inaccuracy can lead to financial losses and problems

- The cost to manually process invoices continues to rise

- Staff spend an increasing amount of time responding to inquiries

*Source: Ardent Partners: The State of ePayables Report 2021

Rewards of the Medius AP Automation solution

- Increased efficiency because everything is automatically processed

- Invoice exceptions can be dramatically reduced saving time and money

- Identify and mitigate fraud risks and protect your financial health

- Analyze spend data to determine where you can optimise working capital

- Access to some of the industry's best accounts payable management software

Common challenges you face

- 45% of invoices have exceptions requiring manual intervention*

- 57% of finance professionals say the invoice and payment process takes too long*

- Less than half of organizations can measure key AP metrics*

- Manual processes cannot be managed in a work-from-home environment

*Source: Ardent Partners: The State of ePayables Report 2021

Risks of not having a solution in place

- Business payment fraud attacks impact nearly four out of 10 businesses*

- Human error and inaccuracy can lead to financial losses and problems

- The cost to manually process invoices continues to rise

- Staff spend an increasing amount of time responding to inquiries

*Source: Ardent Partners: The State of ePayables Report 2021

Rewards of the Medius AP Automation solution

- Increased efficiency because everything is automatically processed

- Invoice exceptions can be dramatically reduced saving time and money

- Identify and mitigate fraud risks and protect your financial health

- Analyze spend data to determine where you can optimise working capital

- Access to some of the industry's best accounts payable management software

Discover how Medius AP Automation works for yourself

Move through our interactive demo below to get an inside look at how our solution works for users. Simply click through the guides that display, or choose a topic in the sidebar to jump to.

Check out the Medius Savings Calculator

With a few simple numbers you can easily compare your own metrics with those of Medius customers. Download a custom savings report for even more details you can share with your team as you build a business case.

Break the accounts payable bottleneck with Medius AP Automation Solutions

Medius AP Automation features

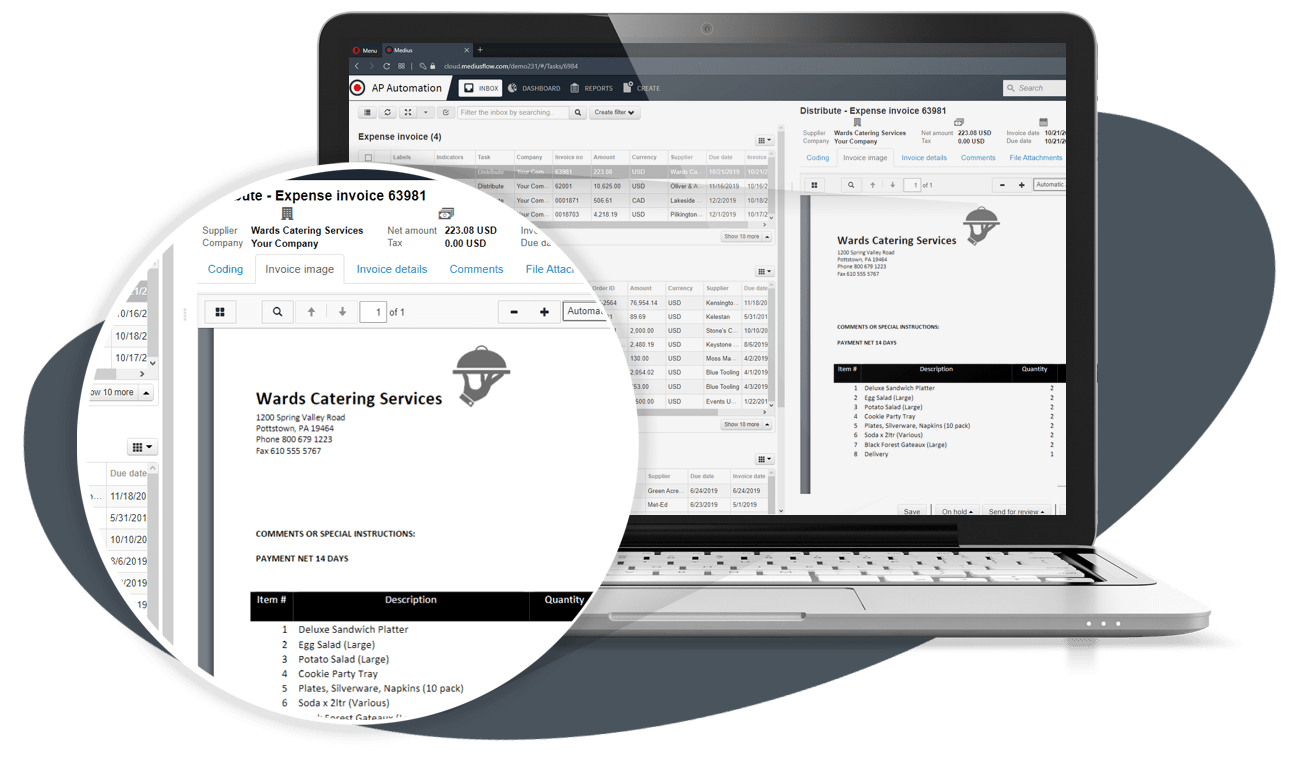

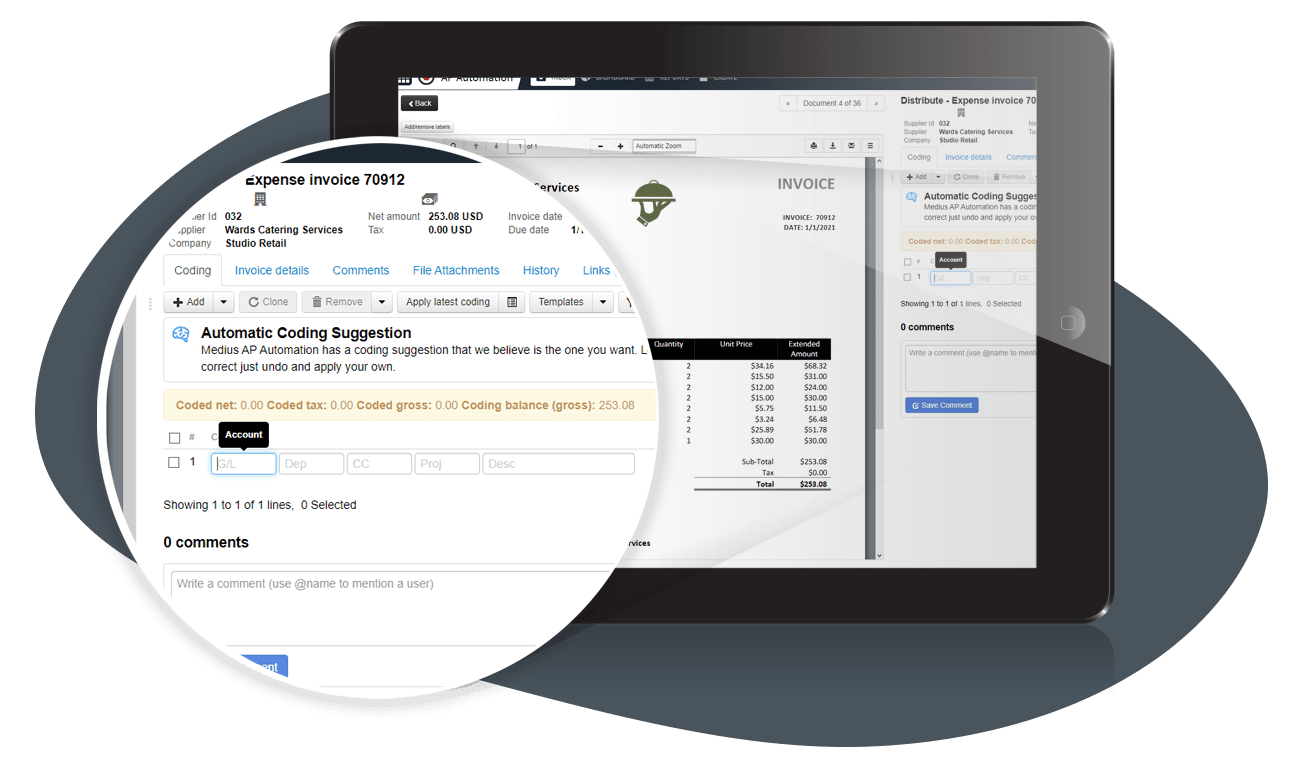

Intelligent invoice and touchless data capture

Our state-of-the-art data capture solution is native to Medius AP Automation and expertly pinpoints and extracts invoice data automatically. It’s powered by our innovative ‘touchless capture’ technology – clever AI that removes guesswork. Original invoices are automatically archived in Medius' automated AP software for you to audit whenever you need them.

Three-way matching

Automatic three-way matching allows your business to resolve discrepancies in invoices, POs, and receivables. You can safeguard your assets, avoid fraudulent invoices, and make sure you pay the correct amounts.

Integrate with Microsoft Dynamics, SAP, Infor, and more

Integrate Medius Accounts Payable Automation Tools with your organization's ERP or accounting system and connect solutions across the procure-to-pay lifecycle. Out-of-the-box integration makes it easy for your IT team to onboard AP Workflow Automation, managing the systems and processes with a predictable timescale and set of resources.

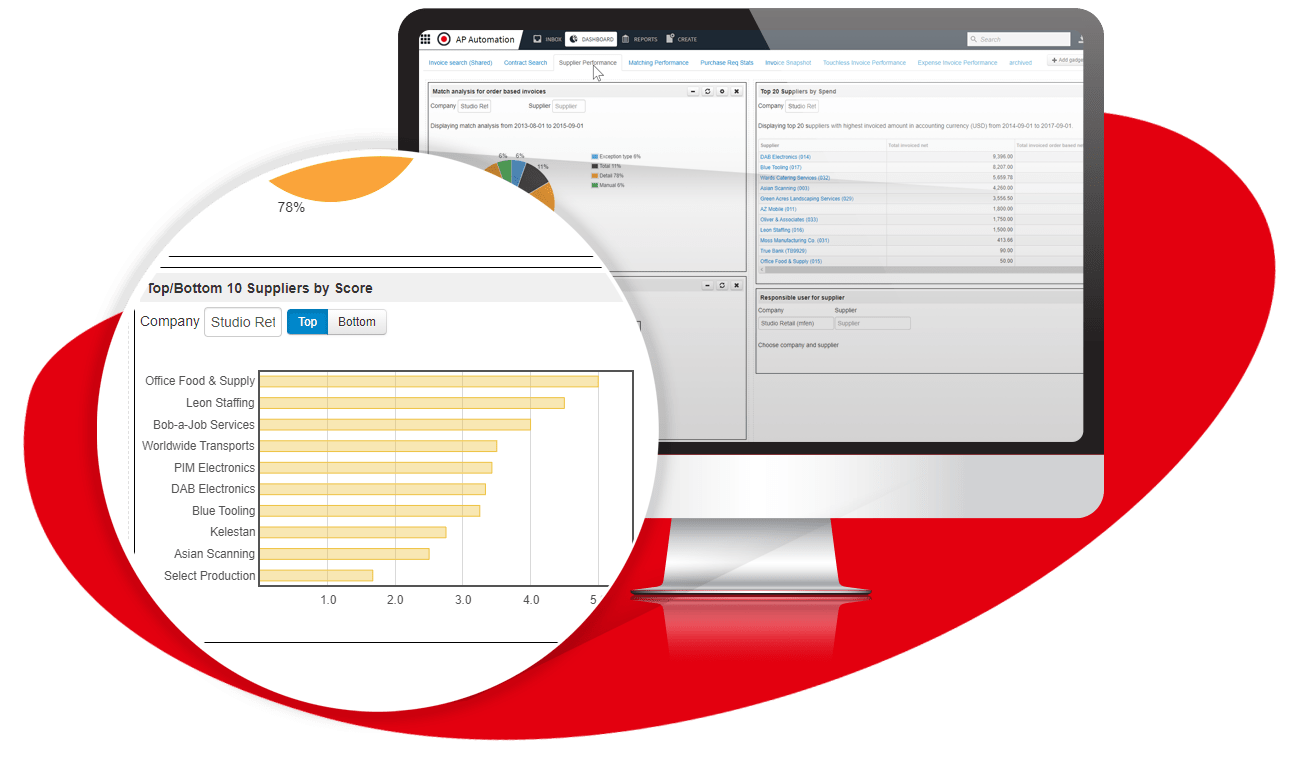

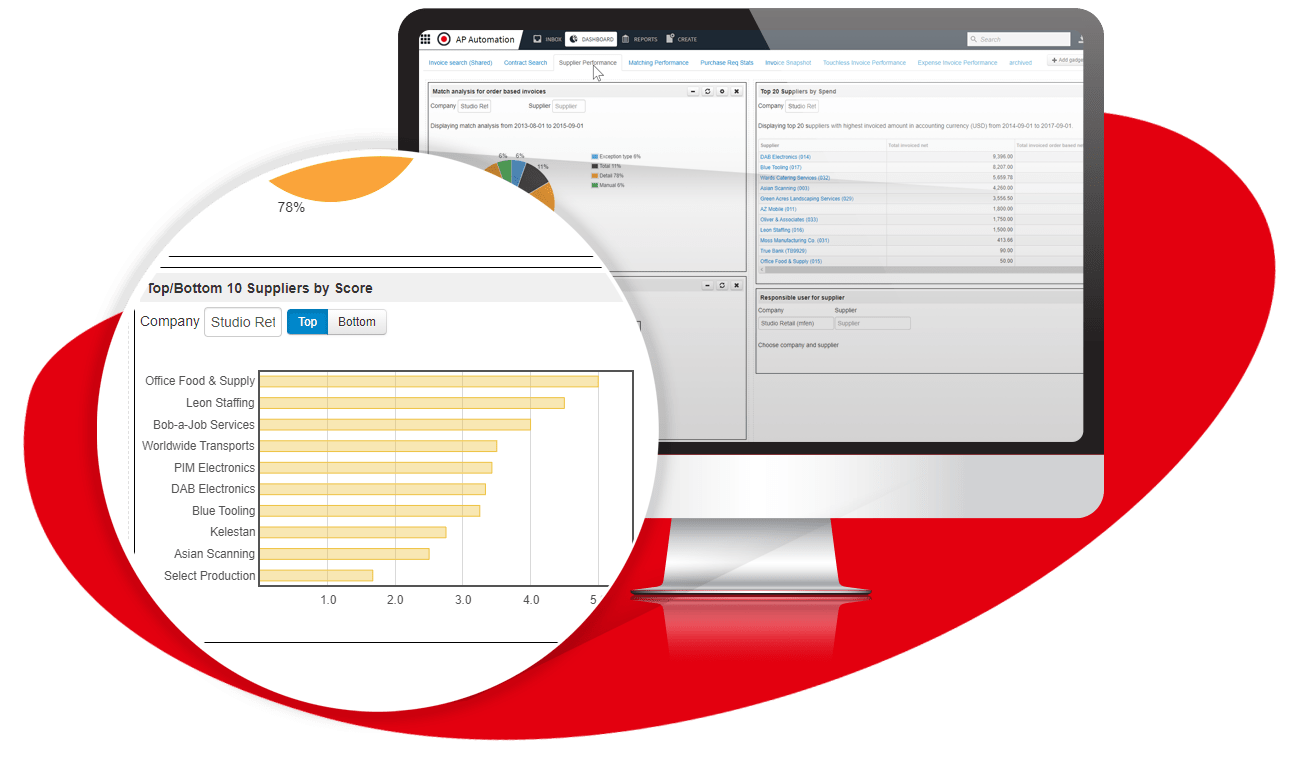

Use spend data to make better business decisions

Utilizing account payable solutions will allow you to broaden your insight into your business spending. Predefined reports, dashboards, and KPIs give you a full view into how money is spent and help you better manage cash flow. Study captured and missed discounts, working capital and more so you can tune operational performance.

Streamline the supplier payment process

Integrate Medius AP Automation with Medius Pay for a simple, secure, and streamlined vendor payment process that allows you to pay all your domestic and international suppliers via a single channel.

Integrate Medius AP Automation with your back-office

Rapidly bring together your back-office and third-party systems using Medius Connect. It features:

- Out of the box connectors for major ERP systems means a rapid and predictable implementation

- Native embedded capture means a single user interface to manage all invoices from initial input to final approval

- Seamless integration with our modular solutions - such as Medius Pay - to complete, initiate, and manage payments, Medius Contract Management to tie contracts to payment agreements, and of course Medius Procurement to ensure employees order the right goods and services up front and invoices can be automatically matched without issue.

Join these organizations who depend on Medius to spend smart

Download our brochures to see what Medius can do

Download our brochures to see what Medius can do

More resources we think you'll like

More resources we think you'll like

Bring a data-driven approach to your AP

AP: work smarter, not harder with Medius Analytics

Use your accounts payable team’s secret weapon – its own data – to boost operational efficiencies with Medius Analytics. Our deep-dive dashboards and reports help you increase cash flow visibility, better manage suppliers, drill into process bottlenecks and so much more.

Benefits of AP Automation Software

Human error is a risk in any process, and there’s plenty of room for mistakes to occur in traditional, labor-intensive accounts payable departments. By using accounts payable automation solutions, these processes can be automated, reducing risk and fraud to ensure that finance operations run more smoothly.

Using AP automated systems removes the need for dated paper filing systems, and the storage space required. Easily convert paper invoices, POs, or other finance documents into a digital format. By digitizing data, organizations can extract more value from these documents that are otherwise literally gathering dust and occupying space.

How can you measure your company spending if you can’t see it? You need both a holistic and a detailed view of spend across the procure-to-pay lifecycle so that you can optimize your working capital. With a comprehensive accounts payable solution like Medius Analytics you get dashboards and reports to help you increase cash flow visibility, better manage suppliers, drill into process bottlenecks, and so much more.

With automated accounts payable solutions, work flows from person-to-person, system-to-system and logical next steps “just happen,” so your teams won’t get bogged down with process and they can get more done.

ePayments offer a higher level of efficiency, visibility, and accuracy to your organization and to your extended supply chain. Plus, you get greater collaboration between trading partners with financial value for everyone.

Don't take our word for it. Hear from one of our clients.

Medius has been really important for me to be able to do my job - gone are the days where we go to cabinets and pull invoices!

Blanca McGrory

AP Manager, Lush Handmade Cosmetics

Accounts payable automation software FAQs

What is accounts payable automation software?

Accounts payable automation is the act of moving away from manual AP processes to a digitized and streamlined solution that automates everything from invoice capture and processing right on through to payment. But why stop at basic automation? Medius goes beyond basic AP automation by using artificial intelligence (AI) to do the work—invoices get coded, approved and paid while you get to go home and rest easy.

Accounts payable automation software is designed to rid you of many of the manual aspects of accounts payable systems. It’s specifically useful in facilitating the automatic creation, review, and approval of invoices digitally—rather than having to receive, scan, and manage paper documents.

There are plenty of accounts payable automation vendors out there, proving that anyone can automate AP approvals. That's why Medius has put together a line of accounts payable tools that stand to revolutionize the way you work. With the Medius Accounts Payable Automation solution, AP processes can be streamlined and managed more efficiently to provide better visibility and control over an organization’s finances.

By using automated software, you can be more efficient, reduce errors and risk, and allow your company to scale quickly and easily.

What is AP automation?

AP automation uses software to digitize invoicing processes and remove manual tasks to create faster, cost-effective, and more accurate AP workflows. AI accounts payable software can replace your AP workflows through intelligent data learning.

How does AP automation software work?

AP automation software converts your suppliers’ invoices into a standard digital format and then uses a series of digital workflows to verify and process the information throughout the procure-to-pay lifecycle.

AP automation software uses Artificial Intelligence (AI), machine learning, optical character recognition (OCR), and other technologies to extract information from invoices and convert them from paper documents into digital formats. These supplier invoices can then be processed via digital workflows to manage steps in the procure-to-pay process previously handled by an AP staff member.

How do you automate the AP process?

Get started with AP automation by installing an AI engine to learn and extract information from paper invoices in the background. The AI software builds digital workflows to automate invoice and payment processes.

How do you automate AP processes?

- Digitize paper documents

- Select an AP automation solution

- Automate manual processes

- Consolidate AP processes under one digital portal

- Unlock AP data with reports and dashboards

What are the benefits of AP automation?

Decrease instances of fraud and overpayment by automating AP processes. You will also save time and money by reducing manual tasks previously handled by accounts payable employees.

What are the benefits of AP automation?

- Payment protection

- Fraud protection

- Reduce manual tasks

- Decrease data entry errors

- Reduce AP costs

- Scale your business at little to no extra cost

Why use AP automation software?

With AP automation software, you can automate the entire AP process – from invoice capture to payment so your organization can:

- Control costs and get better visibility of working capital

- Reduce time AP staff spends on data entry, auditing, and exception handling

- Improve supplier relations

- Capture early payment discounts

- Reduce the risk of payment fraud

What should I look for in AP automation software?

Look for an AP automation software that captures data from paper invoices, automates electronic payments, and integrates with your existing software. AI accounts payable automation software learns from data to create custom automation and cost savings.

What should you look for in AP automation software?

- Optical character recognition (OCR) scanning

- Automated payments

- Vendor management

- Data learning

- Easy integration

- Dashboards and performance KPIs

What is E-invoicing?

Electronic invoicing (e-invoicing) is an electronically-delivered invoice in a standardized format. AP automation software leverages e-invoicing to save time and money in accounts payable workflows.

- See more: What is E-invoicing

What is automated invoice processing?

Automated invoicing uses configured AP software to process invoices. Accounts payable automation software improves invoicing processing efficiency, from creation to payment reconciliation.

How does automated payment reconciliation work?

Automated payment reconciliation works by integrating a digital payment solution into AP workflows to manage payment approvals as well as conduct risk review audits to deter fraud. Once authorized, payments are automatically transferred to the bank.

How does automated PO matching work?

Automated purchase order (PO) matching works by leveraging AI to reconcile invoices to purchase orders by automatically verifying invoices to match both purchase orders and receipts.

How does automation software help AP teams scale?

Automation software helps AP teams scale by capturing data faster and more efficiently than manual processing, enabling teams to increase their workload without incurring overhead costs. AP automation also eliminates costly data entry errors.

How does automation software help AP teams scale?

- Increases AP workflow efficiency

- Reduces manual processes

- Eliminates human data entry errors

- Saves time and human capital

- Reduces overall cost per account

- Better view of AP data for strategic decision making

How does B2B payment processing work with AP automation software?

B2B payment processing works with AP automation software to employ a 3-way matching process that verifies invoice accuracy against both purchase orders and receipts, thus reducing late payments and costly errors. AP automation eliminates late B2B payments that damage your organization's reputation and production schedules.

B2B payment processing works with AP automation software by employing a 3-way matching process to flag inaccuracies across:

- Invoices

- Purchase orders

- Receipts

How does Medius’ AP software handle tax compliance?

Our AP automation software handles tax compliance by analyzing crucial data in real-time to ensure compliance with ongoing changes to tax codes. Medius reduces costly human errors by automating tax workflows into AI-powered data learning software.

Can AP automation prevent duplicate payments?

Yes! Accounts payable automation can help prevent duplicate invoices and duplicate payments by leveraging a 3-way matching process to verify invoice accuracy against both purchase orders and receipts. AP automation reduces the occurrence of costly human data entry errors, e.g. late payments and overpayment.

Do vendors interact with AP automation software?

Yes! Medius Suppliers Management streamlines processes for your vendors by enabling them to interact with your AP automation software through all stages of the onboarding journey, from initial setup through ongoing management. Eliminate costly manual tasks by empowering your vendors to update their information via a dedicated self-serve portal. They’ll also receive automatic updates on the status of their invoices and anticipated payments so you can avoid daily “status update” calls from dozens of vendors.

What is OCR scanning and how does it work?

Optical character recognition (OCR) scanning is the process of extracting text from scanned images, allowing you to turn paper-based documents into editable, searchable digital documents. Reducing paper assets like invoices, contracts, purchase orders, and receipts enables you to improve AP workflows while simultaneously reducing expensive data entry errors.

Why is AP automation important?

Accounts payable (AP) automation software saves businesses time and money by reducing manual tasks and the costly errors associated with them. AP automation is important for scaling your business because it reduces overhead costs associated with manual processing.

Why is AP automation important?

- Decrease manual processes

- Reduce account AP costs

- Eliminate human errors

- Open visibility into key financial data and metrics

- Meet tax and regulatory compliance

- Reduce instances of fraud and underpayment

- Scale your business at little to no cost