Transform your supplier payments process with Medius Pay

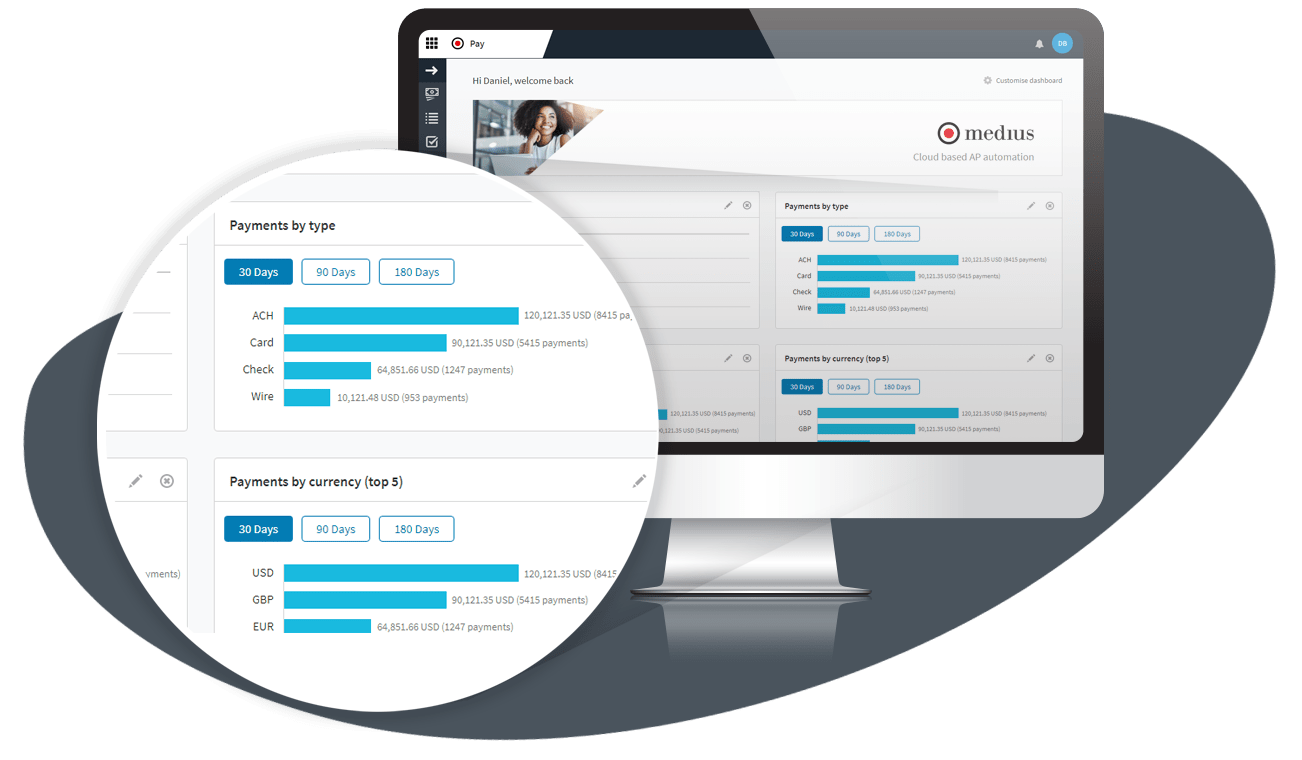

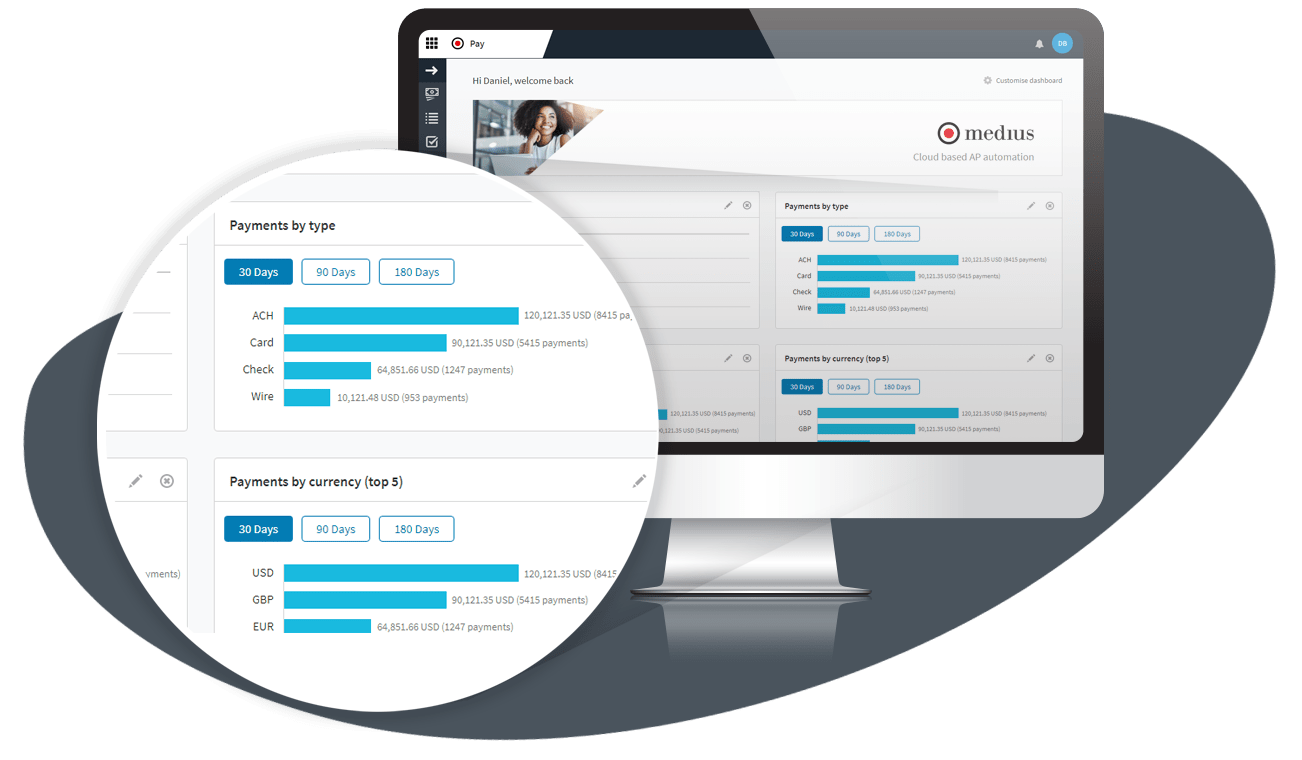

Reinvent supplier payments with a single automated process regardless of payment method — our spend management solution Medius Pay takes care of all your check, ACH and card payments in one seamless process.

Why Medius Pay?

Streamline the invoice to pay process

Bring efficiency and automation to the last mile of invoicing via business spend management software featuring a fully integrated AP Automation and payments solution

Save time and cut costs

Use spend management software to eliminate multiple payment routines and manual intervention while earning a guaranteed dividend from credit card payments

Improve security, reduce risk of fraud

Eliminate manual tasks, create clear audit trails, and reduce errors with top business spend management tools and a fully automated invoice-to-pay process

All your supplier payments managed through one automated process

Common challenges you face

- Traditional payment processes touch several different systems and include numerous manual touchpoints

- While cross-border business activities continue to increase, international payments still involve lengthy processes and heavy bank fees

- 2020 was the largest year on record in terms of fraudulent payment behavior*

- Only a third of businesses have automated the payment execution process*

*Source: Ardent Partners: The State of ePayables 2021

Risks of not having a solution in place

- 38% of businesses reported a B2B payment fraud attack attempt over the past year*

- Lengthy invoice to pay processes result in delayed supplier payments, lost discount opportunities and potential supply chain disruption

- Manual steps increase the risk of errors, mistakes and fraudulent payments

*Source: Ardent Partners: The State of ePayables Report 2021

Rewards of the Medius Pay solution

- Enhanced security with automated risk-scoring, digital audit trail and file transfer from ERP to bank with secure integration

- Faster payments with less effort thanks to a streamlined process in one system for invoice and payment processing

- Cost-efficient cross-border payments, allowing for same-day value transfer and zero wire fees for your international suppliers

Common challenges you face

- Traditional payment processes touch several different systems and include numerous manual touchpoints

- While cross-border business activities continue to increase, international payments still involve lengthy processes and heavy bank fees

- 2020 was the largest year on record in terms of fraudulent payment behavior*

- Only a third of businesses have automated the payment execution process*

*Source: Ardent Partners: The State of ePayables 2021

Risks of not having a solution in place

- 38% of businesses reported a B2B payment fraud attack attempt over the past year*

- Lengthy invoice to pay processes result in delayed supplier payments, lost discount opportunities and potential supply chain disruption

- Manual steps increase the risk of errors, mistakes and fraudulent payments

*Source: Ardent Partners: The State of ePayables Report 2021

Rewards of the Medius Pay solution

- Enhanced security with automated risk-scoring, digital audit trail and file transfer from ERP to bank with secure integration

- Faster payments with less effort thanks to a streamlined process in one system for invoice and payment processing

- Cost-efficient cross-border payments, allowing for same-day value transfer and zero wire fees for your international suppliers

Stop paying your suppliers the old-fashioned way. Use payment automation from Medius

Cut the cost of making payments

One process for all payment types

Total control and visibility

Stronger supplier relationships

Don't limit your productivity benefits to just payments

A unified Invoice-to-Pay solution

Join these organizations who depend on Medius to spend smart

Don't take our word for it. Hear from one of our clients.

Once we understood that we could outsource so many tasks - make payments via check, ACH, and credit cards - and that we could get some money back, it was a huge factor for us.

Natalie Cahoone

Senior Corporate Accounting Manager, CURO Financial Technologies Corp

More resources we think you'll like

More resources we think you'll like

Supplier Payment Solutions FAQs

Supplier payments solutions help businesses execute supplier payments in a digital, secure and efficient process. Supplier invoices are processed and approved as part of the accounts payable process often using an accounts payable automation solution. Once invoices are approved the next step is to authorize and transfer the payment to the supplier according to the agreed payment method.

In many organizations, the payment process is fragmented, fractured and open to the risk of error or fraud due to inefficient manual touchpoints. This is where supplier payments solutions can support by removing manual steps and consolidating processes into a single digital payments channel.

Many supplier payment solutions include automation functionality to further accelerate the payment process. These systems may also offer risk scoring features to help identify potentially fraudulent invoices and prevent payment mistakes.

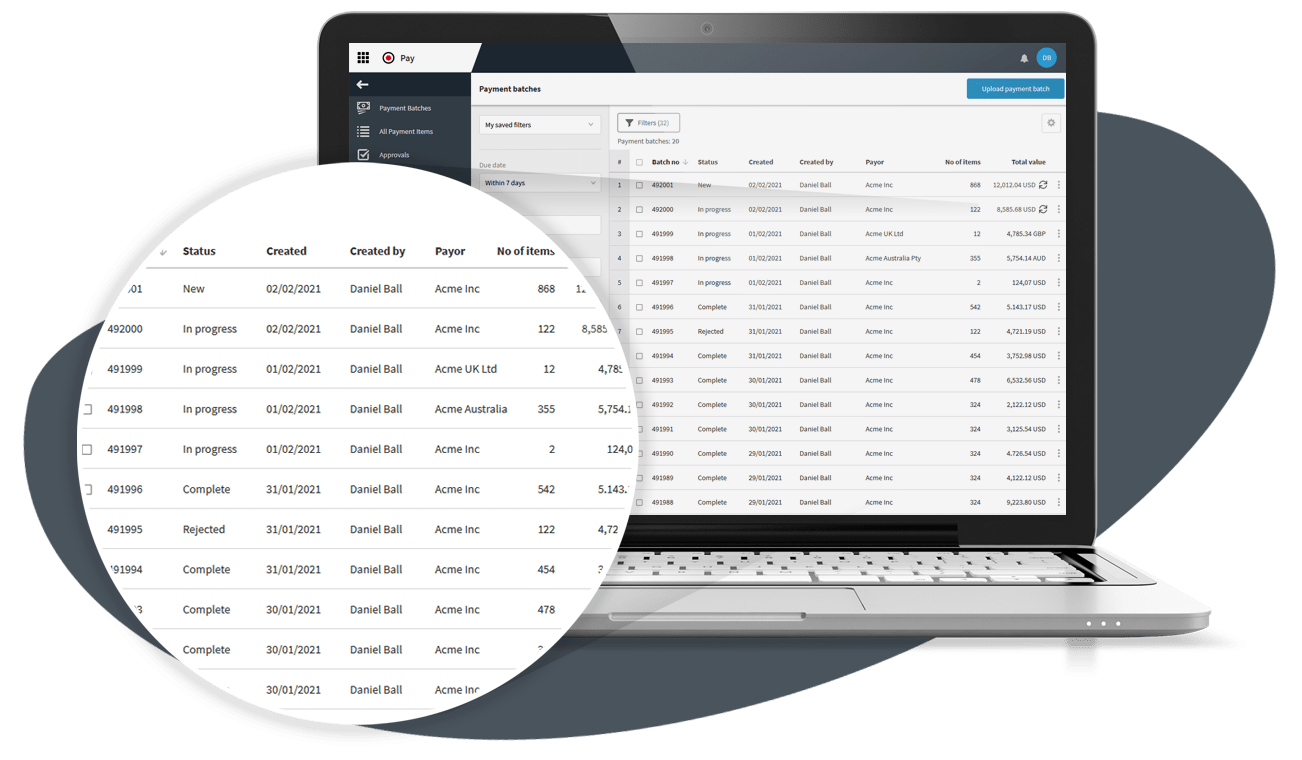

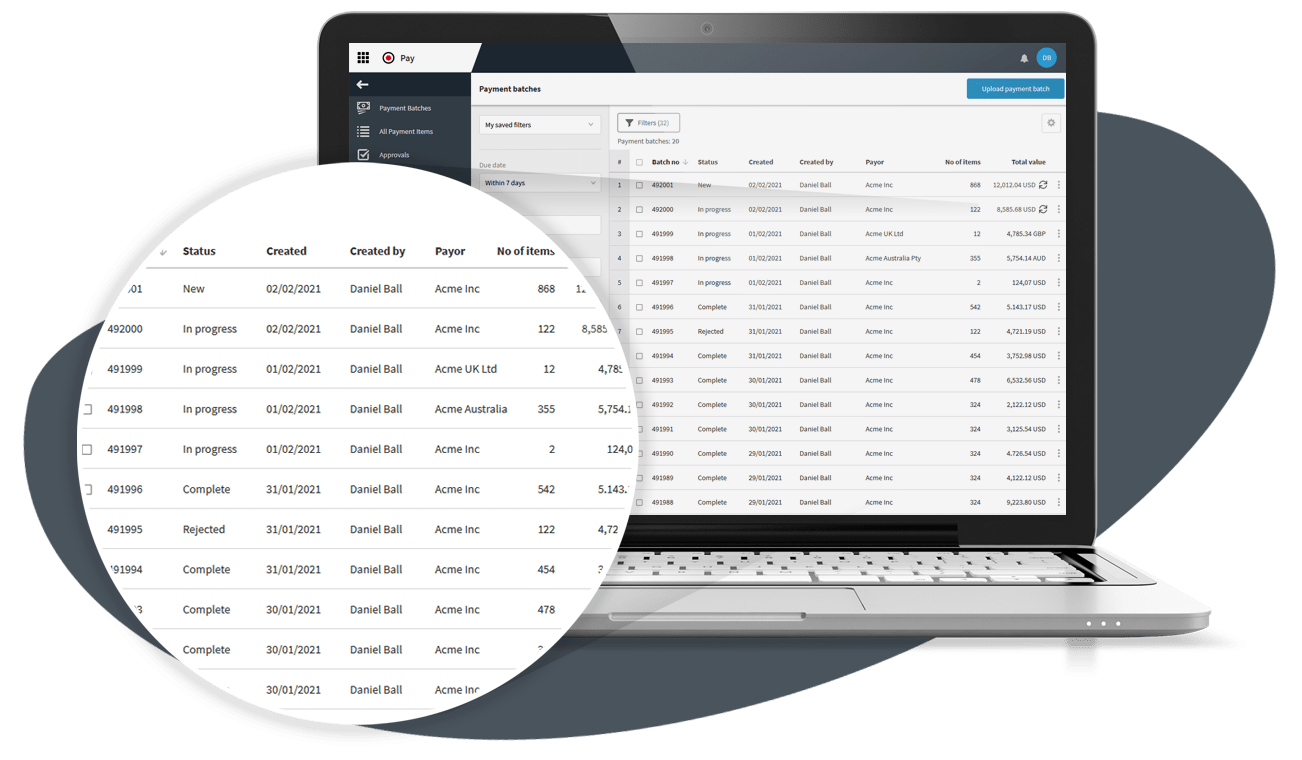

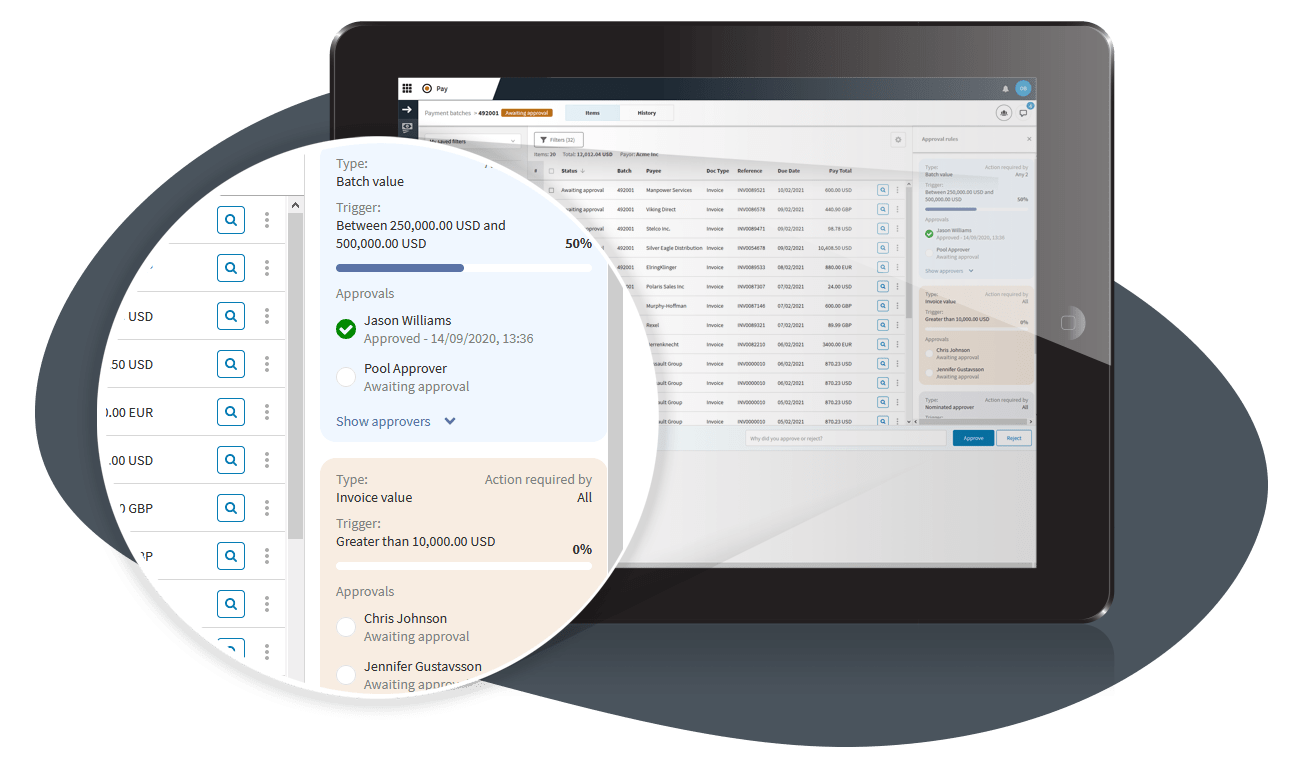

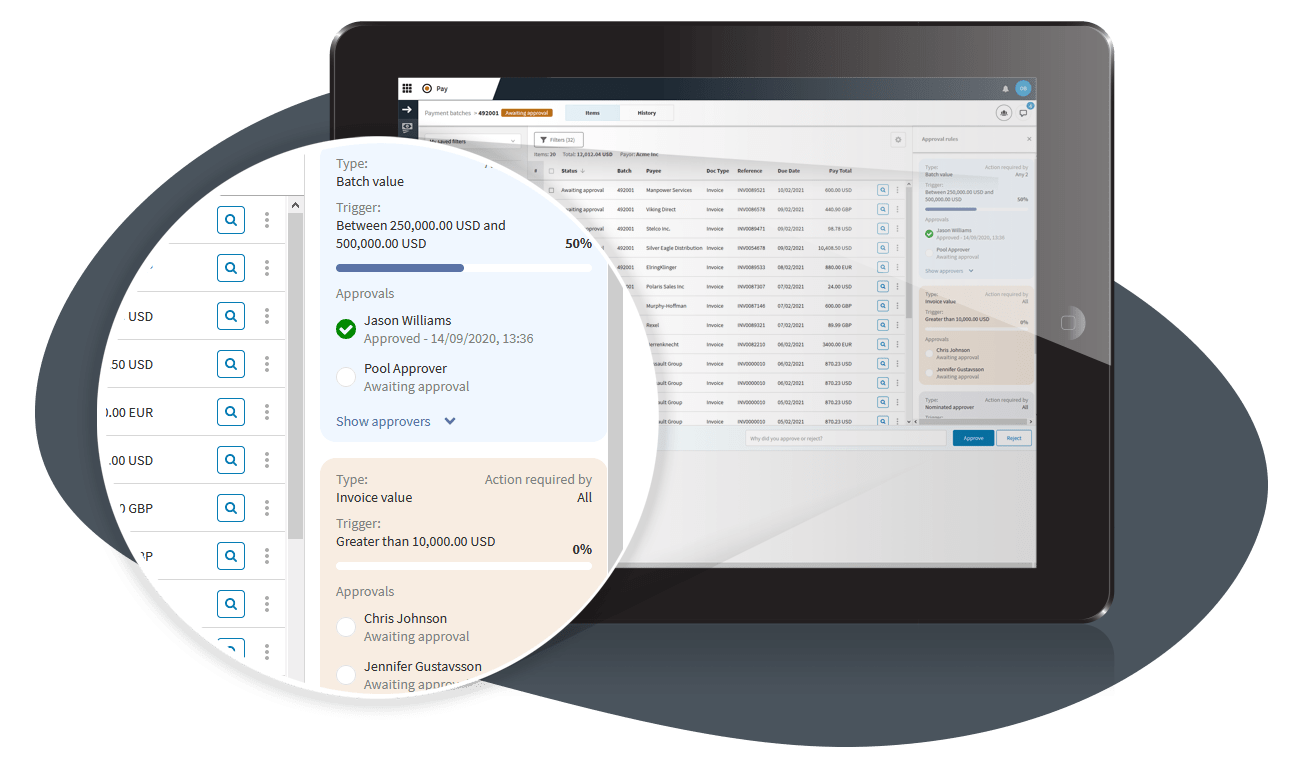

Supplier payments solutions digitize and consolidate disparate processes into one streamlined channel for all supplier payments. When a supplier invoice is approved and posted to the ERP system a payment file is transferred to the supplier payment solution. Then the supplier payments solution will conduct an automatic risk scoring and payment review before initiating the payment approval process.

Once everything is clear and authorized payments may be released via a file integration to the organization’s bank.

The main functions of supplier payments solutions include digital approval processes, automatic risk scoring, fraud detection, and bank file integrations.

With supplier payments solutions, businesses can remove lengthy and error-prone manual approval processes via email or signature on paper. Instead, all review and approval steps are conducted in a secure online tool allowing for full visibility and audit trail of payment transactions.

Digital supplier payments solutions also include risk scoring functions that automatically identify anomalies – such as a new supplier, changed supplier banking details or duplicate payments –to stop potential fraud.

Bank integration is another important function where supplier payment solutions can offer a secure and fast data flow from the business ERP system directly to the bank enabling faster payment transactions.

There are many reasons for businesses to use supplier payments software. Firstly, it will remove manual touchpoints and digitize the entire payment process. Not only does this enable a fast and efficient payment execution, but it also removes the risk of errors and mistakes.

Secondly, supplier payments software can be used to automatically identify invoice anomalies to reduce the risk of fraud and duplicate payments.

Thirdly, businesses that use supplier payments software will generate important cost savings. Internal efficiency gains allow staff to spend their time on more value-added tasks. And timely payments to suppliers will remove late payment fees as well as potentially generate early pay discounts. There may also be opportunities to avoid cross-border bank transfer fees if the supplier payments software is connected to an international bank network.

Businesses can automate supplier payments processes using a digital payment solution, preferably integrated with the accounts payable system to allow for a streamlined invoice to pay process.

Traditionally many steps of the supplier payments process, including uploading transaction files to bank portals and obtaining payment authorization, have been managed manually.

A supplier payment solution can automatically conduct a risk review and flag potential fraudulent invoices as well as manage the payment approvals in a fully digital process. Once payments are authorized a transaction file can automatically be transferred to the bank via a file integration.